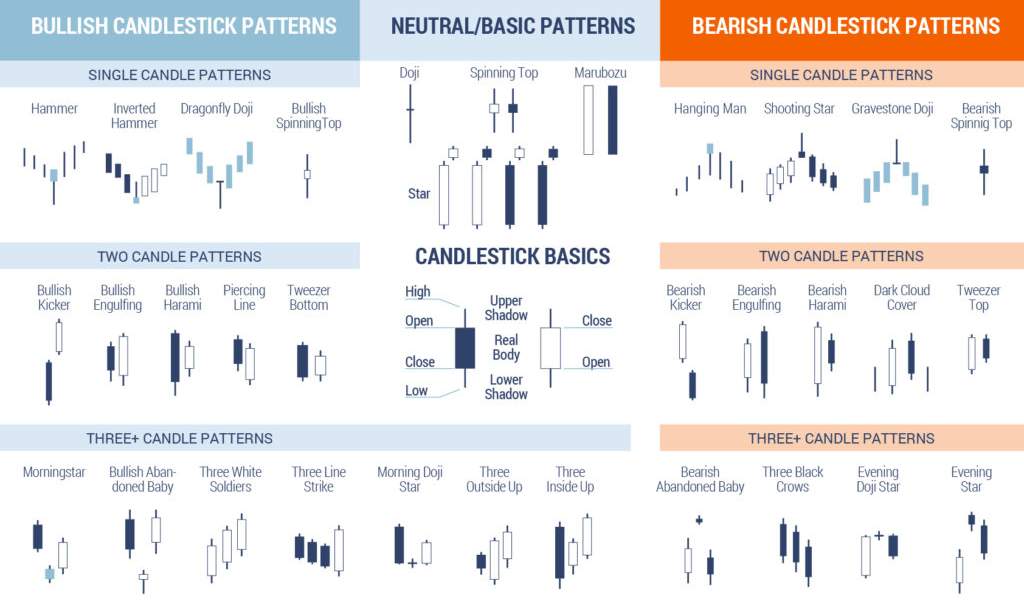

Candlestick Patterns

All About Candlestick Patterns

- Quora - How do I analyze a Candlestick Pattern?

- ToneVays: This is a quick reference on Technical Trading and what you need to know

- Babypips - Triple Candlestick Patterns

Intro

@cryptocred on candlestick charts

@cryptocred on candlestick charts

Shadows

Long shadows serve as an indicator of the comparative strengths between the buyers and the sellers. The longer the shadow, the more likely prices move in the opposite direction.

source: Forex Candlesticks Made Easy

Doji

All doji are created when price closes at or around the same price as opening, and all gains or losses are returned. The length and direction of the shadow are important indicators. Doji commonly appear when there is indecision in the market, at a turning point in a trend.

You will find it during periods of resting after big moves higher or lower. When found at the bottom or top of a trend, it is a sign that trend is losing strength.

As an indecisive indicator, look for confirmation.

- Investopedia - Terms - Doji

- Tradingview - Ideas - Doji

- Tradingview - Education - Doji

- Tradingview - Scripts - Doji

Reversal Candlesticks

-

Tradingview - Scripts - Reversal Patterns

- Engulfing

- Harami

- Piercing Line

- Morning Star

- Evening Star

- Belt Hold

- Three White Soldiers

- Three Black Crows

- Three Stars in the South

- Stick Sandwich

- Meeting Line

- Kicking

- Ladder Bottom

According to Bulkowski, the most reliable reversal candlestick patterns are:

Three Stars in the South

Rare but Potent, bullish reversal

- Bulkowski - Three Stars in the South

-

Investopedia - Three Stars in the South

- Appears in a downtrend.

- The first candle long and black, long lower shadow, no upper shadow.

- The second candle is black with a shorter body and higher low than the previous candle.

- The third candle has a shorter body, no shadows, and close within the high-low range of the second candle.

Three Line Strike, Bearish

Bullish Reversal

Supposed to be a bearish continuation, but is bullish according to Bulkowski.

Three white soldiers

Rare bullish reversal.

- Bulkowski - Three White Soldiers

- Tradingview - Ideas - Three White Soldiers

- Tradingview - Scripts - Three White Soldiers

- Investopedia - Trading Strategy - Three White Soldiers

Three black crows

Bullish Reversal

- CandleScanner - Three Black Crows

- Tradingview - Ideas - Three Black Crows

- Tradingview - Scripts - Three Black Crows

- Bulkowski - Three Black Crows

Identical three crows

Each days opening is near the previous days close, sucessively lower, a bearish reversal of the uptrend. Not common, but reliable.

Engulfing, bearish

A reliable bearish reversal where second candle is bullish with a longer body in both directions than the previous bullish candle.

- TradingView - Ideas - Bearish Engulfing

- TradingView - Scripts - Bearish Engulfing

- Investopedia - Bearish Engulfing

- Bulkowski - Bearish Engulfing

Morning star

Bullish Reversal

- Bulkowski - Morning Star

- TradingView - Scripts - Morning Star

- TradingView - Ideas - Morning Star

- Tradingview - Education - Morning Star

Morning doji star

- Babypips - Morning and Evening Star

- Bulkowski - Morning Doji Star

- CandleScanner - Morning - Doji Star

Bullish Reversal: Same idea as the morning star, but doji.

Evening star

Bearish Reversal

- Babypips - Morning and Evening Star

- TradingView - Ideas - Evening Star

- Tradingview - Scripts - Evening Star

- Bulkowski - Evening Star

- Investopedia - Evening Star

Three outside up

Bullish Reversal

- Investopedia - Three Outside Up\Down

- CandleScanner - Three Outside Up

- Bulkowski - Three Outside Up

- TradingView - Scripts - Three Outside Up

Shooting Star

Shooting Star is supposed to be a bearish reversal occuring in an uptrend. Accoring to bulkowski that reversal happens only 60% of the time.

Overall I will pass on these, since there is no clear indication from either.

Abandoned Baby

Bearish Breakaway

Rare Bearish Reversal

Top Performing Continuation Patterns

^^^includes a number of his top reversal patterns, only including continuance patterns not already described

Inverted Hammer

Inverted hammer is supposed to be a bullish reversal when occuring in a downtrend but a well performing bearish continuation around 60% of the time, according to Bulkowski.

DYOR on Inverted Hammer

Upside Tasuki Gap

Bullish Continuation

- Bulkowski - Upside Tasuki Gap

- CandleScanner - Upside Tasuki Gap

- Investopedia - Upside Tasuki Gap

- TradingView - Scripts - Upside Tasuki

Matching Low

Well performing bearish continuation 60% according to bulkowski. According to prevailing thought its a reversal pattern.

The following are the top performing candlesticks from a pirated copy of Bulkowski’s rankings that I can’t include here:

Another I’ll pass on until I can DYOR.

Window, Falling

Two Black Gapping Candle

Stick Sandwich

Thrusting

Meeting Lines

In Neck

Meeting Lines

Long Black Day

Three Inside Up

Homing Pigeon

Dark Cloud Cover

Downside Tasuki Gap

Edit this page

Social Share

Twitter Facebook LinkedIn Reddit

| Bitcoin | DOGE |

|---|---|

| 1A1DZfw4VgpHCgnMjnmfDnMjddKf8xdYbd | DQKkzfJjqnXUD8Z7C3e84vKzvghPe9dXSa |

|

|